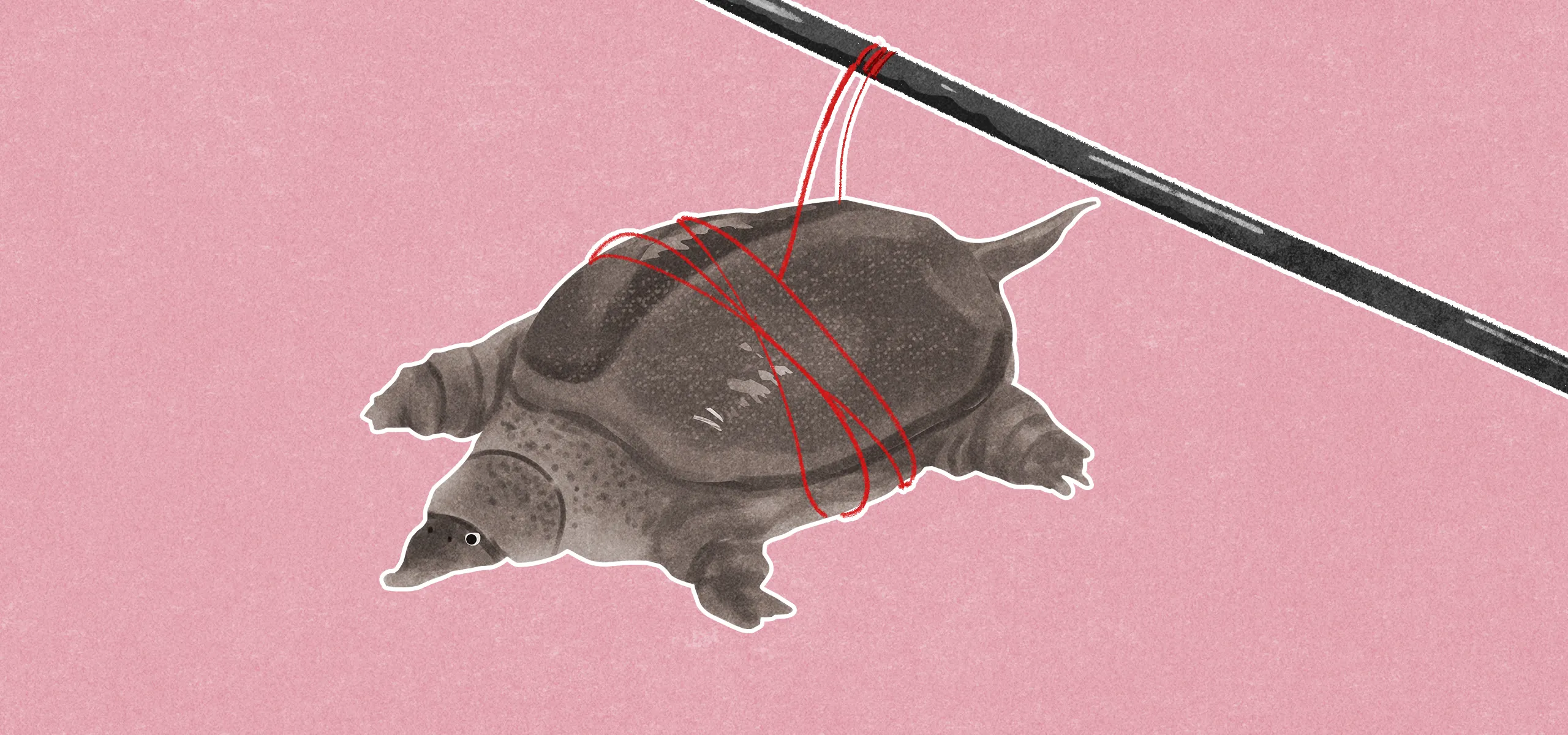

As the coastal town of Humen urbanizes, the softshell turtle industry, which boomed in the 1990s, is losing its appeal

Business is slow in the turtle industry. Seventy-year-old Chen Zhiman, who began farming softshell turtles in 1992, ceased all operations in 2012. His farm in Humen, a coastal town in southern China’s Guangdong province, bears no trace of the 1 million softshell turtles (鳖, biē in Chinese) that he raised over 20 years.

Chen’s farm is already humid in May, the air heavy with the promise of summer. Cicadas buzz overhead, and chickens cluck sleepily beneath the heat. From broad-leafed trees droop clusters of ripe bananas and mangos, which Chen peels and offers to TWOC as he carves a path through his fields. He stops at a small shed bordering a pond, and gestures at the water. His ponds—dug specifically for softshell turtles in 1992, and covered with white tarp to protect from predatory birds—have since been repurposed for fish.

“In the 1990s, I could make 200,000 to 300,000 yuan per mu [around 667 square meters] of turtle farmland,” Chen tells TWOC. “By 2012, I was only making 10,000 yuan per mu. Turtles aren’t worth it anymore.” Like Chen, many of Humen’s turtle farmers have turned to more profitable sources of income, and softshell turtles have almost entirely vanished from the town’s wet markets. Humen’s turtle industry is slowly going into its shell.

Softshell turtles have historically enjoyed a semi-mythical status in China for their medicinal properties. The turtles of Chinese legend are said to live for over 10,000 years; their flesh is prized as a cure for fertility issues, cancer, and rheumatism. They are an especially popular delicacy in southern China. Several of Humen’s folk recipes include the stomach shell of a female hardshell turtle to align qi flow or heal bruises. Male softshell turtles, on the other hand, are cooked whole to boost energy levels and improve skin texture.

Read more about China’s rural cultures:

Though turtles have been farmed in China since the Zhou dynasty (1046 – 256 BCE), the practice was largely reserved for the rich. Turtles only became widely available during the early 1990s, as China’s nascent middle class began to seek the prestige and novelty of exotic wildlife. This craze was amplified by the endorsement of Chinese national running coach Ma Junren, whose long-distance track team broke multiple world records at the 1993 Stuttgart World Championships and the Chinese National Games in Beijing. Ma credited his athletes’ success to a formula of softshell turtle blood and caterpillar fungus. The following year, at the 1994 Hiroshima Asian Games, his softshell-based Ma-One elixir sold for 7 US dollars per 20-milliliter vial. Ma’s recipe was even acquired for 10 million yuan by Guangzhou-based health company Zhongshan Robust Health Products. He would continue endorsing softshell-based products throughout the 1990s, even as his athletes came under scrutiny for doping.

Chen was unaware of Ma’s popularity and of the craze that possessed China’s middle class. Still, seeing potential in the business, he traveled north to Hunan province in 1992, where he purchased dozens of softshell turtle spawn. “It wasn’t just me,” Chen says. “Hundreds of people started farming softshell turtles that year. I know 20 or 30 friends who went to Hunan to buy spawn.” Hunan—specifically the area bordering Dongting Lake—is the natural habitat of the Chinese softshell turtle (中华鳖). Hunanese farmers have long farmed turtles for consumption, a practice easily adaptable to Guangdong’s humid climate and nutrient-rich ecology.

Once he returned to Humen, Chen employed dozens of migrant workers from Guangxi to dig six turtle ponds and an irrigation network that pumped fresh seawater from the Pearl River Delta to each pond. Though he had never farmed animals for consumption, his venture proved wildly successful. Throughout the 1990s, Chen raised over 3,000 softshell turtles on each mu of farmland. He turned a profit of 70 yuan for each jin (0.5 kilogram) of turtle, resulting in a staggering annual income of around 7 million yuan. He sold the turtles to wet market merchants specializing in exotic and expensive seafood, who would then retail them to restaurants or hotels.

Humen’s turtle boom also owed itself to China’s rapid growth and globalization during the Reform and Opening Up era. Separate reports from the New York Turtle and Tortoise Society (compiled in 1997) and the Turtle and Tortoise Newsletter (compiled in 2000) found that the wet markets of Shenzhen and Guangzhou boasted dozens of softshell turtle species from China and Southeast Asia, many of them illegal imports. A few of Humen’s farmers had taken advantage of the wet markets’ diversity to purchase turtle spawn from Southeast Asian countries such as Vietnam and Thailand, which they used to experiment with crossbreeding. But when asked whether he participated in the international turtle trade, Chen scoffs dismissively. “I never bothered with turtles from other countries,” he says. “Chinese turtles are the best, both in flavor and nutritional value.”

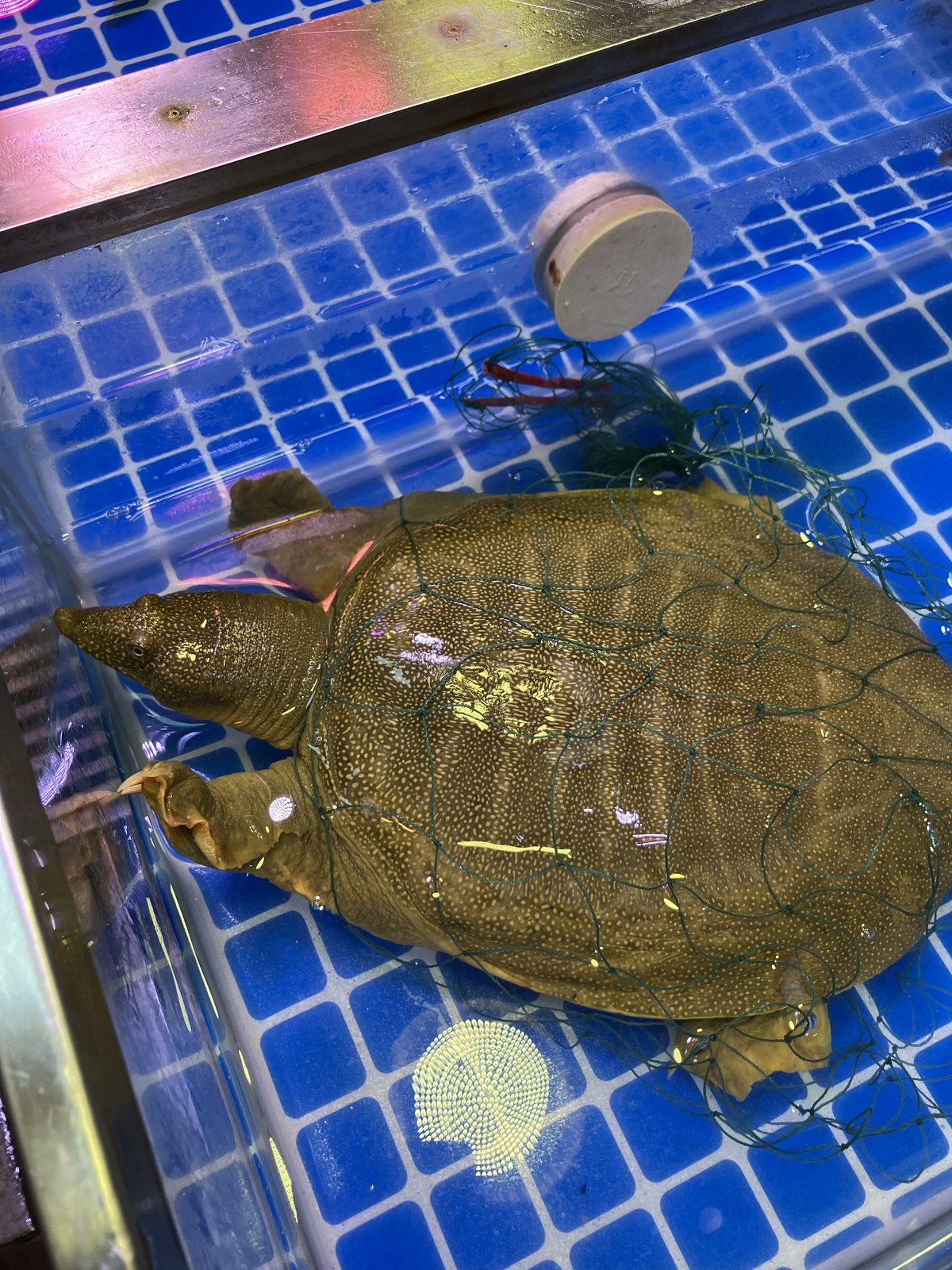

The profitability of a turtle, however, was determined not by its nutritional value or place of origin, but by its size. In the 1990s, small turtles were valued more highly than large turtles. “Wedding banquets liked to serve each table of guests with one turtle, so it was more profitable for them to purchase several small turtles at once,” says Li Zhen, a merchant who asked to be identified by a pseudonym for this piece. He has spent the last decade selling farmed and fresh-caught seafood in Humen’s New Harbor Market. Nowadays, merchants there retail turtles for between 50 and 75 yuan per jin, a fraction of their cost in the 1990s. Li is one of the market’s only two vendors who continue to sell softshell turtles.

In recent years, larger turtles have become more desirable than their smaller counterparts. Individual consumers—particularly grandparents who believe in the auspiciousness and healing potential of softshell turtles—have overtaken restaurants as the wet markets’ most consistent patrons. They typically purchase one or two larger turtles at a time, rather than several smaller ones.

On the other hand, Humen’s younger generations are often too busy to cook and prioritize the convenience of their food over its freshness. They rarely visit the wet markets for live animals. In 2020, reports of antibiotic overuse in turtle farms, published by supervisory bureaus across Guangdong province, may have further discouraged young consumers from purchasing turtles. When TWOC visited the Humen New Harbor Market, most of the customers were elderly grandparents or middle-aged women, who strolled leisurely through the stalls—a marked contrast to the speed and hustle of the streets outside. About a dozen merchants had laid out Japanese snacks and children’s toys to attract younger patrons, but few customers spared them a glance.

The dwindling popularity of turtles among Humen’s younger generation came hand in hand with another issue—the rising costs of turtle farming. In 1993, Humen’s farmers could rent farmland for 500 yuan per mu; the cost is 3,000 yuan per mu today. Chen, who owned 30 mu of land in the 1990s, now possesses less than 10. Turtle feed used to cost 7,000 yuan per ton, and has since almost doubled to 13,000 yuan per ton. But labor costs have seen the most drastic increase. Chen could once hire migrant workers for 300 yuan per month; now, their starting salary is 5,000 yuan per month. “I used to turn a profit of 70 yuan per jin of turtle,” he tells TWOC. “By 2012, I couldn’t even make 8 yuan per jin.” Chen estimates that over 200,000 turtles were sold annually in Humen during the 1990s. Now, that number has fallen beneath 100,000.

Chen, who relied on selling turtles for 20 years, is pivoting to new industries. “Back then, I needed the money,” he recalls. “Conditions in Humen town were bad. I promised my mother that she would never go hungry as long as I lived.” He never finished elementary school and worked a variety of jobs to support his five siblings, wife, and parents. Despite his relative financial stability, Chen continues to work. He keeps several accounting books stacked by his bedside, filled with meticulous calculations and sales records. And after selling his last batch of turtles in 2012, he repurposed his ponds for bighead carp, which are hardier and easier to raise. According to him, it wasn’t too hard to transition away from turtle farming. “The turtles taught me what it means to work with diligence and care,” he says. “These are lessons I can apply to any industry.”

Like Chen, most of Humen’s original turtle farmers have also turned to other sources of income. “A few farmers have gone to other villages to continue farming turtles,” he says, citing Foshan’s Shunde district and Zhongshan city as two areas that still boast sizable turtle industries. “But there aren’t many. All of us farmers have gotten old, and there’s no reason for Humen’s younger generation to keep farming turtles. They’re not used to manual labor, anyway. There are better ways to make money.” The apparel sector has become the town’s pillar industry, employing over 200,000 people—nearly a quarter of Humen’s residents. Chen still raises a dozen softshell turtles, but only to gift them to his close friends and family members, all of whom are in their seventies.

Tightened conservation laws may have also impacted local and national turtle markets. Chen’s friends, who profited from the introduction and crossbreeding of foreign turtle breeds in the 1990s, would now find their practice impossible. In 2021, it became illegal to introduce or release an invasive alien species anywhere in the country. In June of this year, the People’s Court of Zhuhai city held China’s first public trial regarding the illegal introduction of an alien species. The defendant had attempted to smuggle 1,760 red-eared slider turtles into Guangdong province. He pled guilty and awaits further sentencing.

However, the decline in Humen’s turtle industry doesn’t signify the demise of turtle farming in China. Markets around Hunan province’s Dongting Lake, the natural habitat of softshell turtles, still boast annual sales of 1 billion yuan, according to finance media outlet Time News. Turtles can still be found for exorbitant prices across China: The Beijing-based restaurant Xiaoxiang Turtle Village sells softshell turtle dishes for between 800 and 1,500 yuan per serving, while the upper- and middle-class residents of Jiangsu province and Hong Kong consider turtles to be a delicacy.

The most ardent consumers of turtles are still the people of Hunan province, who prepare them for Lunar New Year feasts. As one Dongting-based farmer asserted in an interview with Time News, softshell turtles are lucky animals, as they “only climb forward, not backward”—a testament to their prevailing significance in Hunanese culture.

As for the turtles still farmed in Humen, Chen already has plans for them. “We won’t let the turtles back into the wild!” he laughs. “We will not let them into the streets to wreak havoc. Mark my words: before this industry dies, we in Humen will eat every last one.”

Bye Bye Bie: Behind Southern China’s Vanishing Turtle Farms is a story from our issue, “Back to the Wild.” To read the entire issue, become a subscriber and receive the full magazine.