Chinese shoppers reinvigorate North American shopping

Apart from cul-de-sacs and freeways, no institution is perhaps more American than the shopping mall. But in the present century, the great malls of the US and neighboring Canada are said to be dying—enfeebled by economic decline and reverse suburban flight, while online retailers like Amazon put the nail in the coffin.

In 2015, research firm Euromonitor noted a trend. While retail in Canada on the whole suffered from a weak economy and a low Canadian dollar from 2014 to 2015, ominously signalled by the departure of several flagship stores from Toronto and Vancouver’s downtown cores, the luxury retail sector grew tremendously and was described in Canadian media as “crowded”. Several branded international retailers moved in to occupy major vacating storefronts in Canadian cities, including Nordstrom and Saks. The responsible party? Chinese consumers.

South of the border, certain rural and depressed regions—including Tulalip, Washington, and parts of Southern California—have seen their local economies pick up due to influxes of Chinese visitors to retail locations of many hues and price points: outlet malls to small boutiques, branded department stores to Rodeo Drive. Marketing agency Digital Luxury Group estimates that 78 percent of total overseas consumption by Chinese consumers in 2015 took place in the US. According to Visit Seattle, Chinese visitors to the region spend 70 percent of their travel budgets on shopping, while the proportion is 77 percent for visitors to Canada.

But it’s not in just the size and spending volume of Chinese consumers that are influencing North American retail. As the money flows in, stores reinvest in expansions and physical renovations, as well as changes to their service and marketing methods that indicate not only optimistic growth and a desire to keep riding the gravy train, but that Chinese buyers’ newfound power is shaping the experience of physical shopping.

It’s important to clarify first that while the media tends to speak of the Chinese “tourist shopper” as one lump category—carrying unfortunate shades of the historical treatment of Asian Americans and Canadians as “perpetual aliens”—it can be difficult to draw the line when it comes to tourist and actual immigrant or resident. This is doubly difficult in wealthy Chinese immigrant enclaves such as Vancouver and certain suburbs of Los Angeles given the extreme mobility of its population, parts or all of whose wealth may still be generated in China though they nominally live or hold citizenship abroad. Then, there are the Chinese who live in or visit North American cities to buy for friends and family, or on behalf of clients back in China for a commission.

Tour buses pulling into designer outlets are an easy visual cue for the tourist shopper, but other icons, such as wealthy “parachute kids” or the cast of the Vancouver-based reality show, Ultra Rich Asian Girls, boggle conventional definitions of who the shoppers are and what they want. The only thing that is clear is that these all fall into the tremendous growth of the Chinese economy that created an expanding middle class as well as a class of the ultra-rich, who each in their own way are looking to live and consume at a level consistent with their status. Actually buying the product in the country of origin is an added sign of prestige.

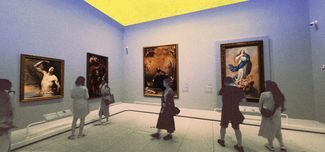

It becomes important, therefore, that the trip conforms to expectations of what living in and visiting “the West” actually looks and feels like. While Lunar New Year celebrations, Mandarin-speaking sales associates, and accepting UnionPay cards have been favorite marketing tactics of retailers hoping to hang onto the Chinese market in recent years, the McArthurglen Group, a UK-based developer of designer outlet malls, emphasizes European architectural details and physical layout, which resembles a village with piazzas and cobblestone paths almost like the European-style “copy” villages built in China. Having started out with hyper-aestheticized malls actually located in Europe, McArthurglen built its first North American location near the Vancouver Airport targeting tourists transiting nearby (shoppers coming from the city have to pay an added airport fare to take the Skytrain home), which according to local media is a strategy to create a “high-end” experience while hosting mostly midprice or designer discount stores; the McArthurglen Group could not be reached for comment.

For the flagship stores of Nordstrom and Holt Renfrew in the city itself, located just across from one another, physical details and amenities also prove important when vying for shares of the actual high-end market. Both recently installed glass awnings (Nordstrom to the main store, Holt Renfrew for its new Chanel boutique) to replace the traditional stucco storefronts of their respective streets and show off the glitzy interior— photos of the Chanel entrance, along with impeccably attired Chinese shoppers in front of it, regularly appear in feeds on Sina Weibo, including Holt’s own.

Holt’s Canadian locations have also been upgraded to include an invitation-only, serviced apartment for guests to enjoy for the day, unironically reflecting the major draws, even more than shopping, that bring Chinese money into Canadian cities. South Coast Plaza and Fashion Island shopping centers in Orange County, California, which have their own mystique in China and are also the inspiration of several copycat housing developments, are making modifications to the traditional closedmall concept to incorporate nature, sunshine, and ocean views into the mall-going experience.

There is also the fact that the supply side of the retail market is simply becoming more international as the market evolves. In the past two years, districts such as Vancouver’s Alberni Street and Toronto’s Bloor Street, as well as shopping centers such as Toronto’s Yorkdale Mall, have controversially seen branded stores and luxury international boutiques such as Tiffany & Co., Burberry, and Christian Dior replace Canadian businesses. Meanwhile, in a suburb east of Seattle that is undergoing a similar transformation with luxury boutiques moving in, the traditional, three-floor, mid-priced “anchor” store JC Penney closed down and was replaced by a more international equivalent, Uniqlo. Though it only occupied one storey, the old anchor space and the rest will be carved up to lease to other stores. This is consistent with the trend throughout the country where declining malls lose their bloated anchors due to shifts’ in consumers’ shopping and socialization habits, but the arrival of an internationally-minded group of consumers, with new demands of the products and experience, means that the ebb of the big-box era does not need to mean the death of retail as a whole.

“Retail Therapy” is a story from our newest issue, “Gender Equality”. To read the whole piece, become a subscriber and receive the full magazine. Alternatively, you can purchase the digital version from the iTunes Store.